annual federal gift tax exclusion 2022

Under this change in 2022 an individual may gift up to 16000 to any person. The amount you can gift to any one person without filing a gift tax form has increased to.

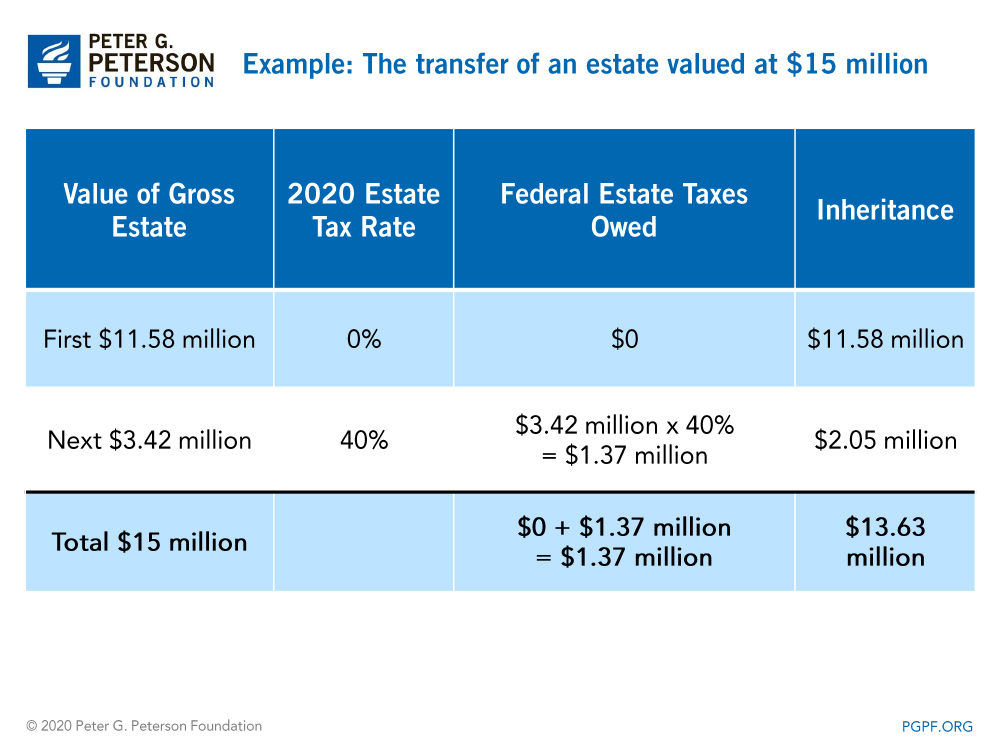

What Are Estate And Gift Taxes And How Do They Work

Income tax extensions are made by using Form 4868 -4- Instructions for Form 709 2022.

. In addition to the lifetime. Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022. The IRSs announcement that the annual gift exclusion will rise for calendar year.

If you want to avoid paying the gift tax stay below the annual exclusion amount which is 16000 in 2022 up from 15000 in 2021. In 2022 the annual gift tax exemption is increased to 16000 per beneficiary. 5 rows Year of Gift Annual Exclusion per Donee.

Gifts that are worth more than that amount. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax. The federal estate tax exclusion has climbed to more than 12 million per individual.

On top of the 16000 annual exclusion in 2022 you get a 1209 million lifetime exclusion in 2022. Additionally the gift tax annual exclusion is 16000 increased from 15000 in 2022 to an unlimited number of people Federal Gift Tax Exclusion For 2022. 1 That means if you had the money you could whip out your checkbook and write 16000 checks to your mom your.

Tennessee repealed its gift tax in 2012. You are allowed to claim the gift tax annual exclusion. How the lifetime gift tax exclusion works.

Under current law the exemption effectively shelters 10 million from tax indexed for inflation. The amount you can gift to any one person on an annual basis without filing a gift tax return is increasing to 16000 in. The amount you can gift to.

This means you can gift this amount to as many. The IRS allows individuals to give away a specific amount of assets or property each year. Now assume instead that in 2022 you give gifts totaling 16000 to each of your three children and a gift of 25000 to a good friend.

Other Gift Tax Rules and Exclusions. In 2022 the amount is 1206 million and in 2023 the amount will increase to 1292. Gifts to beneficiaries are eligible for the annual exclusion.

The gift tax exclusion for 2022 is 16000 per recipient. Residents of all states of course still have to abide by federal gift tax laws. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each.

The gifts to your children and the first 16000 of. Effective January 1 2023 the gift tax annual exclusion will increase from 16000 2022 number to 17000 per recipient. Under current law the exemption effectively shelters 10 million from tax indexed for inflation.

The federal estate tax exclusion is also climbing to more than 12 million per individual. If gifts are made through a trust the trust. And because its per person.

13 rows For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year. Wednesday March 2 2022.

Although there is near-universal acceptance of the. The unified estate and gift tax lifetime exclusion amount is 12060000 and 12920000 for 2022 and 2023 respectively. The federal government imposes a tax on gifts.

2022 federal gift tax return. The 2022 federal annual exclusion amount for gifts is also increased to 16000 up from 15000 in 2021. It can shelter from tax gifts above the annual gift tax exclusion.

For example if you use 500000 of the limit by.

Annual Gift Tax Exclusions First Republic Bank

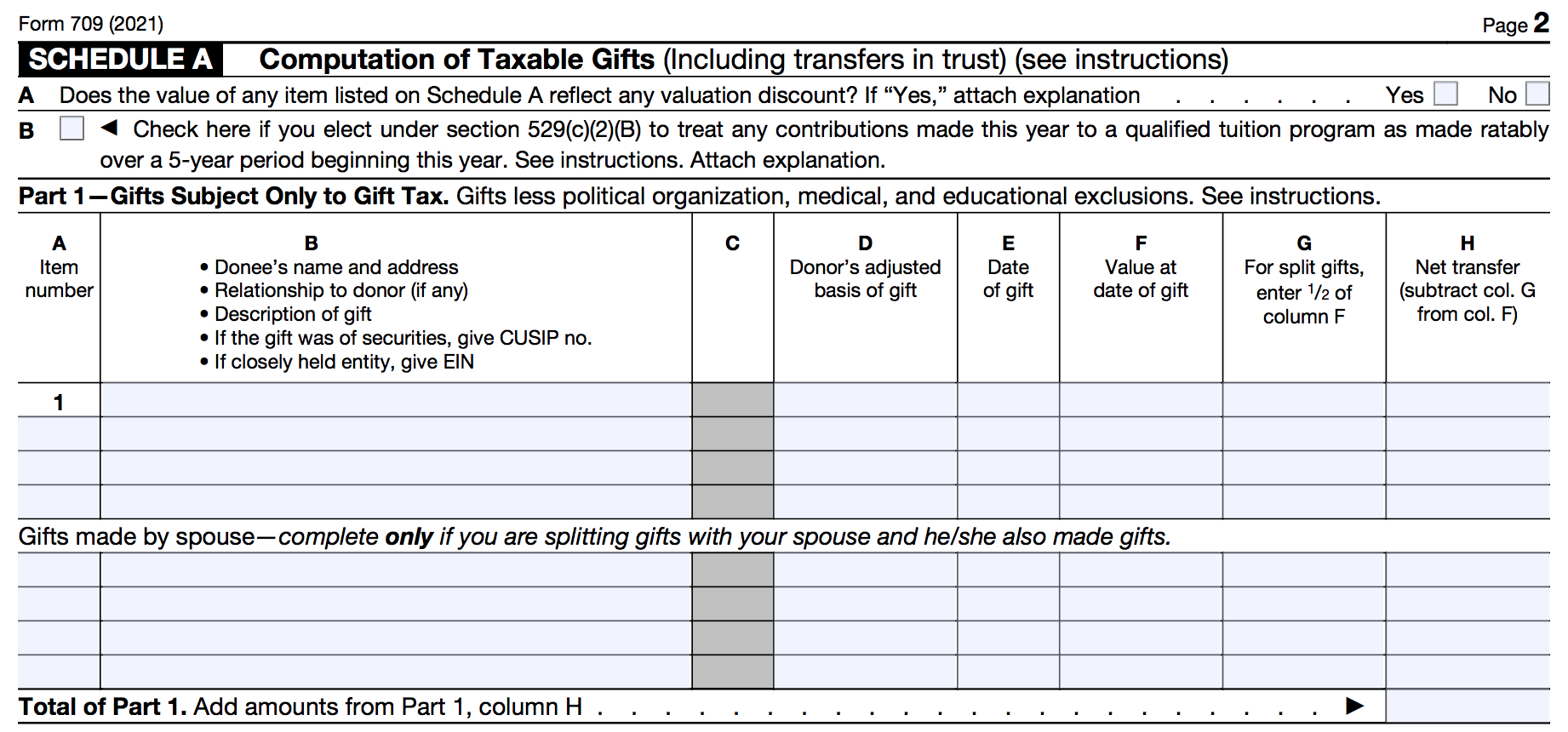

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Frequently Asked Questions On Gift Taxes Internal Revenue Service

Gift Tax Limits For 2022 Annual And Lifetime Magnifymoney

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022 Tesfaye Law

River Valley Law Firm 2022 Estate And Gift Tax Numbers To Know Facebook

Gift Tax Explained 2021 Exemption And Rates

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Annual Gift Tax Exclusion Explained Pnc Insights

Estate Planning Key Numbers Brian Nydegger

What Are Estate And Gift Taxes And How Do They Work

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Msu Extension Montana State University

How Does The Gift Tax Work Personal Finance Club

Estate Tax Exemption Increased For 2023 Anchin Block Anchin Llp

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj