new jersey 529 tax credit

Does the state of New Jersey allow withdrawals from 529 plan to pay for K-12 private school. In 1996 the US.

An Alternative To 529 Plan Superfunding

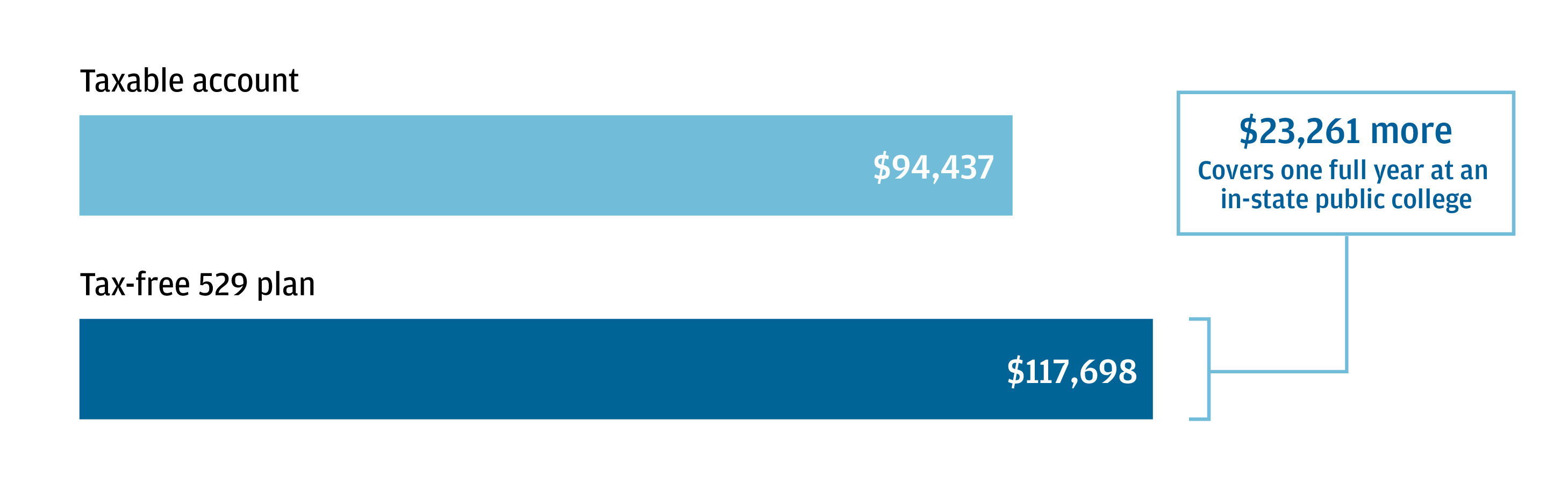

A 529 plan is designed to help save for college.

. The New Jersey Film Digital Media Tax Credit Program provides a transferable credit against the corporation. Web New Jerseys NJBEST 529 College Savings Plan is managed by Franklin Templeton and features age-based and static portfolio options utilizing mutual funds andor ETFs along. Married grandparents in Nebraska who.

Web 30-35 TAX CREDIT 2 or 4 DIVERSITY BONUS. NJBEST New Jerseys 529 College Savings Plan. Web New Jersey 529 Plan Tax Information.

Web Section 529 - Qualified Tuition Plans. On a federal-level there is no tax savings for contributions but. Web NJBEST 529 College Savings Plan.

Web NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority HESAA. Web To apply for the credit complete a New Jersey Schedule NJ-COJ Schedule A for Tax Years 2017 and prior and include it with your New Jersey return. Web Beginning in tax year 2022 New Jersey will join its peers in allowing a state income tax deduction of up to 10000 per taxpayer with a gross income of 200000 or.

Web Unlike traditional IRAs and 401 ks 529 plan contributions are not tax deductible at the federal level. Web A higher education institution is defined under NJSA. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw.

Thanks to recent legislation however you may now be. Web The NJBEST 529 college savings plan would get new incentives to entice parents to save for their kids college educations. 18A71B-36 and means an eligible educational institution as defined in or for purposes of section 529 of.

For my federal return I claim the full 2500. Contributions to such plans are not deductible but the money grows tax-free. Web Say I have qualified education expenses of 10000 and I take a withdrawal of 10000 from a 529 Plan and 1000 are earnings.

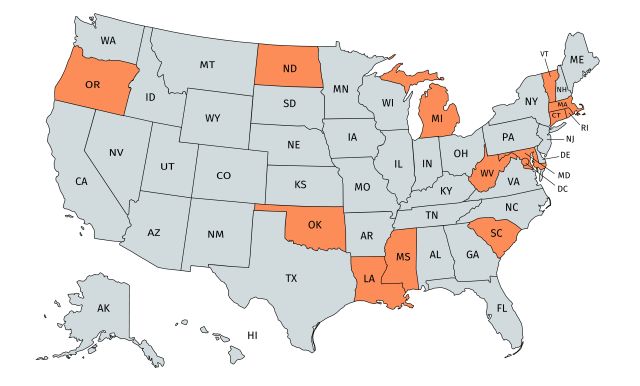

Web In 2022 New Jerseys plan NJBEST joins the majority of states that offer residents an income tax deduction or credit for contributions to the state plan. Web Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary. Franklin Templeton 529 College.

Tax savings is one of the big benefits of using a 529 plan to save for college. The proposed state budget includes.

States That Offer 529 Plan Tax Deductions Bankrate

What Are The 529 Plan Contribution Limits For 2022 Smartasset

529 State Tax Calculator Schwab 529 Savings Plan Charles Schwab

529 Tax Benefits The Education Plan

New Jersey Deductions For Higher Education Expenses And Savings Kulzer Dipadova P A

Saving For College 529 Plans Versus Everything Else

529 Tax Benefits By State Invesco Invesco Us

Why 529 College Savings Plans Are Still Worthwhile Los Angeles Times

How Much Should You Have In A 529 Plan By Age

When Choosing Funds For Your College 529 Plan Don T Make This Mistake Kiplinger

Hecht Group Private Schools In New Jersey Are Exempt From Property Taxes

529 Plan Tax Benefits J P Morgan Asset Management

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

A Rare Tax Break For The Wealthy The 529 Account Physician On Fire

Using A 529 Plan From Another State Or Your Home State

529 Plans Which States Reward College Savers Adviser Investments

Tax Cuts And Jobs Act 529 Plans Expanded

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

Education Savings Accounts Coverdell Esa Vs 529 Plans Vision Retirement